Paperback

-

PICK UP IN STORECheck Availability at Nearby Stores

Available within 2 business hours

Related collections and offers

Overview

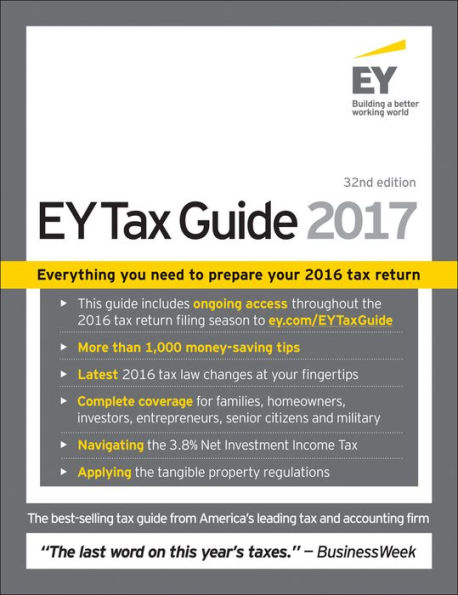

The EY Tax Guide 2017 is the American taxpayer's essential companion, providing the answers you need alongside trusted advice from EY professionals and turning filing your taxes into a simple process. This book brings clarity and ease to an otherwise complex process, helping you see past impenetrable regulations to maximize your return. Covering issues that the normal taxpayer encounters year-in and year-out, this world-class guidebook has been updated to align with the most recent tax law changes that are often misunderstood and typically overlooked in other guides, including a new chapter with insights on the 3.8% levy on certain investment income known as the Net Investment Income Tax (NIIT). This year's guide also includes additional insight on simplified procedures for tangible property regulations and how they affect both individuals and businesses. Situational solutions offer specific advice tailored to homeowners, self-employed entrepreneurs, business executive, and senior citizens, helping you take advantage of every savings opportunity the government offers. At-a-Glance features provide quick guidance on tax breaks and overlooked deductions, new tax laws, and how to avoid common errors so you can dip in as needed and find the answers you need quickly.

The EY Tax professionals keep track of tax law so you don't have to. Their in-depth knowledge and years of experience work together to help you file your taxes correctly and on time, without leaving your hard-earned money on the table. This invaluable resource will help you:

- Maximize your return with tax breaks and deductions

- See how the law has changed since last year's filing

- Avoid 25 common, costly preparation errors

- Identify 50 most overlooked deductions

- Get focused guidance on your specific tax situation

No need to wade through volumes of IRS rulings or indecipherable accounting jargon; top-level tax advice in accessible language is an EY specialty. Make 2017 the year of frustration-free filing, and join the ranks of happy taxpayers with the EY Tax Guide 2017.

Product Details

| ISBN-13: | 9781119248170 |

|---|---|

| Publisher: | Wiley |

| Publication date: | 11/14/2016 |

| Pages: | 1080 |

| Sales rank: | 1,146,093 |

| Product dimensions: | 8.30(w) x 10.80(h) x 1.70(d) |

Table of Contents

2017 tax calendar iiHow to use this guide v

Special contents viii

Changes in the tax law you should know about x

Important 2016 tax reminders xiv

How to avoid 25 common errors xvi

50 of the most easily overlooked deductions xvii

Individual tax organizer xviii

Income and expense records you should keep in addition to your income tax return xxvi

Part I • The income tax return / 1

CHAPTER 1 • Filing information 3

CHAPTER 2 • Filing status 47

CHAPTER 3 • Personal exemptions and dependents 61

CHAPTER 4 • Tax withholding and estimated tax 90

Part II • Income / 119

CHAPTER 5 • Wages, salaries, and other earnings 121

CHAPTER 6 • Tip income 148

CHAPTER 7 • Interest income 158

CHAPTER 8 • Dividends and other corporate distributions 191

CHAPTER 9 • Rental income and expenses 213

CHAPTER 10 • Retirement plans, pensions, and annuities 240

CHAPTER 11 • Social security and equivalent railroad retirement benefits 269

CHAPTER 12 • Other income 282

Part III • Gains and losses / 323

CHAPTER 13 • Basis of property 325

CHAPTER 14 • Sale of property 349

CHAPTER 15 • Selling your home 392

CHAPTER 16 • Reporting gains and losses 413

Part IV • Adjustments to income / 433

CHAPTER 17 • Individual retirement arrangements (IRAs) 435

CHAPTER 18 • Alimony 475

CHAPTER 19 • Education-related adjustments 490

CHAPTER 20 • Moving expenses 499

Part V • Standard deduction and itemized deductions / 515

CHAPTER 21 • Standard deduction 517

CHAPTER 22 • Medical and dental expenses 524

CHAPTER 23 • Taxes you may deduct 545

CHAPTER 24 • Interest expense 560

CHAPTER 25 • Contributions 586

CHAPTER 26 • Nonbusiness casualty and theft losses 617

CHAPTER 27 • Car expenses and other employee business expenses 642

CHAPTER 28 • Tax benefits for work-related education 691

CHAPTER 29 • Miscellaneous deductions 705

CHAPTER 30 • Limit on itemized deductions 729

Part VI • Figuring your taxes and credits / 733

CHAPTER 31 • How to figure your tax 735

CHAPTER 32 • Tax on investment income of certain children 753

CHAPTER 33 • Child and dependent care credit 764

CHAPTER 34 • Credit for the elderly or the disabled 785

CHAPTER 35 • Child tax credit 791

CHAPTER 36 • Education credits and other education tax benefits 795

CHAPTER 37 • Premium Tax Credit (PTC) 808

CHAPTER 38 • Other credits including the earned income credit 815

Part VII • Special situations and tax planning / 857

CHAPTER 39 • Self-employment income: How to file Schedule C 859

CHAPTER 40 • Mutual funds 893

CHAPTER 41 • What to do if you employ domestic help 914

CHAPTER 42 • U.S. citizens working abroad: Tax treatment of foreign earned income 926

CHAPTER 43 • Foreign citizens living in the United States 933

CHAPTER 44 • Decedents: Dealing with the death of a family member 943

CHAPTER 45 • Estate and gift tax planning 960

CHAPTER 46 • Everything you need to know about e-filing 975

CHAPTER 47 • If your return is examined 983

CHAPTER 48 • Rules for expensing and capitalizing tangible property used in a trade or business 999

CHAPTER 49 • Net investment income tax 1009

CHAPTER 50 • Planning ahead for 2017 and beyond 1022

CHAPTER 51 • 2016 Tax rate schedules 1037

Index 1039